What is the Consumer Price Index (CPI)?

Consumer Price Index (CPI) is a price index that measures shifts over time in prices paid by consumers on a market basket of goods and services. This market basket is compiled by recording and assessing frequently bought items for a certain period.

Analysts use price changes on market baskets to check for inflation or the effectiveness of government policy. Items that may be included in a market basket include food and beverages, housing, clothes, transport, medical services, education, or recreation.

Governments use CPI to gauge their citizens’ standards of living. While some calculations will focus on urban households and others on rural communities, national statistical agencies will determine a weighted national CPI reflecting the nation’s cost of living.

There are two types of CPI:

- Consumer Price Index for all Urban Consumers (CPI-U). This accounts for 93% of the American population living in urban areas. It exempts people living in military bases and rural areas.

- Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This accounts for 29% of Americans living on income from clerical employment or paid-by-wage jobs.

How data is collected

The US Bureau of Labor Statistics (BLS) must conduct effective research to obtain accurate CPI. The first step is selecting the item for data analysis, a process known as initiation. The data collector must know the item’s brand, size, and popularity among consumers.

The item is then priced, with reviews of this amount being done periodically, such as bimonthly. After four years, the item is replaced through sample rotation. The new item will now contain the improved styles and additions.

Now, on the consumer side, data is obtained from the US Census to know which areas will be used for this data collection. The Consumer Expenditure Survey provides suitable information on which households purchase what items or services.

Different stores, geographic areas, and commodities will be used to calculate the weighted CPI for a certain population group.

Calculation of CPI

For a single item, CPI is calculated as follows:

Consumer Price Index = Market basket of desired year / Market basket of the base year * 100

This formula compares the price of a single basket of consumer goods and services in a year compared to the same basket’s value during the previous year.

When this CPI is calculated, it is compared with that of the previous year to indicate the rate of inflation;

Rate of inflation = ((New CPI – Previous CPI) / Previous CPI) * 100

The inflation rate will be positive if the market prices are appreciating.

As of September 2022, the BLS has the following CPI categories by weight:

Category | Weight |

Housing | 32.5% |

Commodities, such as vehicles | 21.3% |

Food | 13.6% |

Energy | 8.2% |

Healthcare | 6.9% |

Transportation | 5.9% |

Education | 5.3% |

Other Expenses | 6.3% |

As of September 2022 is 8.2%, which represents 0.1% less than the previous year’s CPI. October’s CPI will be released on November 10, 2022, at 8:30 a.m. Eastern Time.

Uses of CPI

First and foremost, CPI is an indicator for so many aspects of the economy. It reveals how well or poorly the economy is doing after introducing a specific government intervention. The populace’s reaction to such changes will mostly be revealed in their purchasing power and decisions. Conversely, this information can be used by governments to formulate monetary policies.

CPI is used to measure a population’s cost of living. By assessing CPI, you may know how much people spend on particular goods and services, especially those included in the research. However, for more abstract items (those that can only be measured qualitatively), such as education, CPI may not be an adequate quantifier.

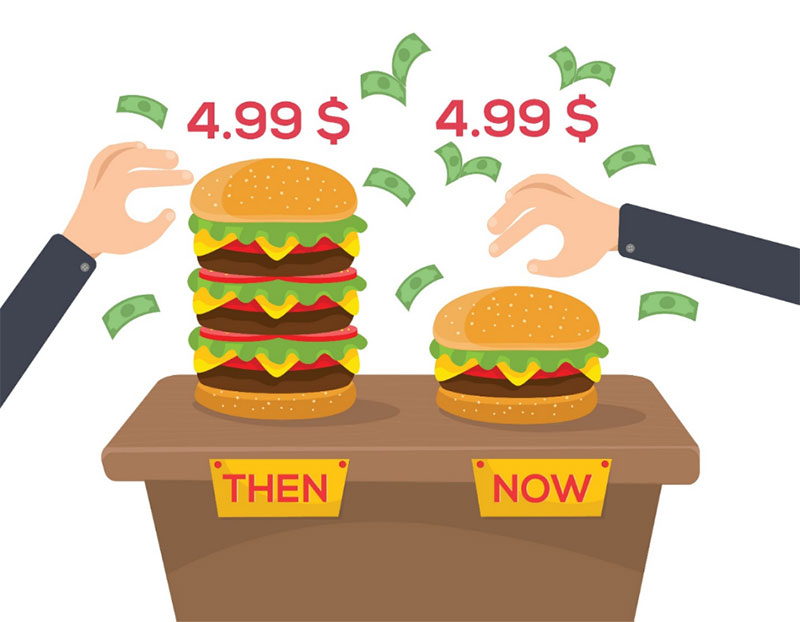

Inflation can be measured as the steadily increasing prices of goods and services or the continuous fall of money’s value. CPI can be used to indicate inflation. It can be used as an effective metric to tell how affordably, or otherwise, consumers are purchasing their daily needs.

The BLS has an ingenious inflation calculator where one can enter the dollar value for any year since 1913. The calculator tells you how much the dollar was worth using the CPI for that calendar year.

Limitations of CPI

CPI may not be an adequate measure of economic performance in a country because it mostly focuses on urban areas, not rural areas. It does not apply to all population groups and not all geographic areas. The urban populace automatically locks out various subgroups, such as the poor and those in rural areas.

The information provided by a CPI data analysis only reveals key data about a particular area. Therefore, the difference is not universal if a certain area has a higher CPI than another. Prices may change faster in different areas than others, automatically impacting their respective CPIs.

Further, even though CPI measures the cost of living as a numerical price change, it does not consider other important factors that affect living standards, such as societal and environmental factors. Sampling, data collection, and analysis errors may also affect the CPI.

Frequently Asked Questions (FAQs)

Is CPI the same as inflation?

CPI is one of the most effective measures of inflation in an economy. While it is not inflation, CPI says a lot about inflation rates. CPI is used to adjust other economic indicators. The terms are sometimes interchangeable because inflation can be expressed as a percentage of CPI.

Does CPI affect housing?

Landlords may use current CPI figures and projections to set rent, leases, and other contracts. The CPI for housing reached an all-time high of 306.52 as of September 2022 since 1967. Inflation causes housing prices to rise, so in the same respect, higher CPIs mean higher prices in housing. This may not apply to mortgages.

What is indexation?

When CPI increases, people’s purchasing powers are higher, and the costs of living improve. Indexation takes into account these changes and reflects them in prices and wages. Indexation can be done on wages, tax rates, exchange rates, and financial instruments rates.