Protective puts are an investment strategy that can help investors protect their portfolios from possible losses. This strategy involves purchasing put options, which give investors the right, but not the obligation, to sell a security at a predetermined price within a specific time frame. If the underlying security price goes down, an investor can protect the value of their portfolio by buying a put option. Protective puts are particularly useful for investors who hold long stock positions but are concerned about potential downside risk. This strategy lets them keep their losses to a minimum while still giving them a chance to win. Protective puts are also often used when the market is unstable or uncertain, and investors are worried about the possibility of a market drop. Protective puts can be a good way to deal with risk, but it's important to remember that they come.

How To Use Protective Puts

Investors use protective puts to protect themselves from a drop in security value. To implement this strategy, investors purchase a put option, which gives them the right, but not the obligation, to sell a security at a predetermined price within a specific time frame. This allows investors to limit their potential losses if the underlying security price falls.

Why Protective Puts Are Good

The main benefit of protective puts is that they allow investors to limit their downside risk while still participating in any potential upside gains. This can be helpful for investors who have a big stake in a stock and are worried about the possibility of a drop. Protective puts can also be useful when the market is volatile or uncertain, and investors are worried about the possibility of a market drop.

Cost Of Puts To Protect

Protective puts can be a good way to deal with risk, but they also come with extra costs. One of these costs is the cost of buying a put option, which can change depending on things like the price of the underlying security, the time left until the option expires, and the option's strike price. Options trading can also come with costs like commissions and fees.

Dangers Of Puts To Protect

Protective puts come with risks, just like any other type of investment. One risk is that the cost of the put option itself can be high. Also, the underlying security price might not fall as much as expected. If that happens, the put option would be worth less than before. Another risk is that the put option may expire worthless if the underlying security price does not fall below the option's strike price.

When To Use Protective Puts

Protective puts are a good strategy for investors who own a lot of stock and are worried about the risk of the stock going down. They can also work well when the market is uncertain or volatile. However, protective puts may not be appropriate for all investors or all market conditions. Investors should consider their circumstances and goals carefully before implementing a protective put strategy.

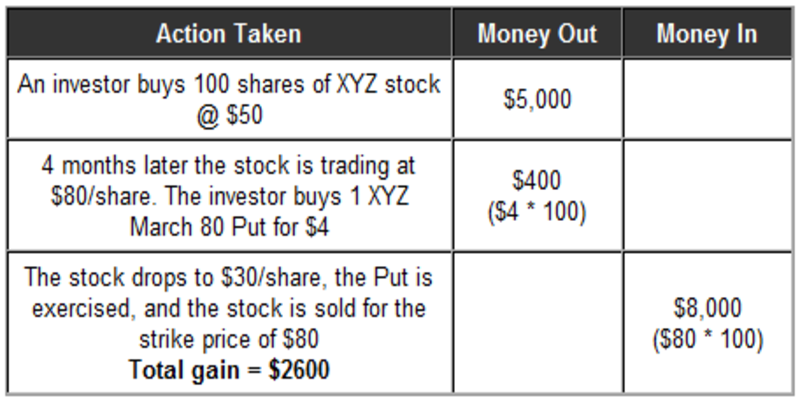

A Protective Put Strategy Example

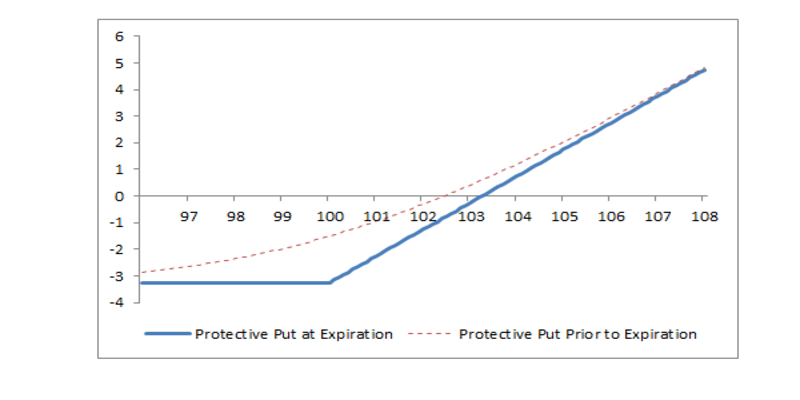

To illustrate how a protective put strategy works, consider an investor with a long stock currently trading at $100 per share. The investor is concerned that the stock may decline but wants to participate in any potential upside gains. The investor buys a put option with a $90 strike price and a three-month expiration date. The price per share of the put option is $3. If the underlying stock's price falls below $90 per share, the investor can exercise the put option and sell the stock at the strike price of $90 per share, limiting their losses. If the underlying stock's price remains above $90 per share, the investor can still participate in any potential upside gains but will have lost the cost of the put option.

Conclusion

Protective puts are a good way to invest for investors who own a lot of a certain stock and are worried about possible losses. They let investors limit their losses while still taking part in any possible gains on the upside. However, protective puts come with additional costs and risks that investors should carefully consider before implementing this strategy. Getting advice from a financial advisor can also help them decide if this strategy is right for their portfolio.