Top Places to Invest in Latin America

Jul 30, 2023 By Rick Novak

If you want to expand your portfolio to Latin America, you've come to the right place. With numerous markets and opportunities for growth, Latin American countries have become a hotbed for investors.

From lucrative investments in commodity-based resources such as oil and minerals to booming tech hubs setting the tone for new growth horizons, there is no shortage of options when it comes to investing in this region of the world.

In this blog post, we'll explore why Latin America should be on every investor's radar as we outline some of its top locations and types of investments available today!

Why Invest In Latin America

Latin America has become an attractive destination for investors due to its potential for growth and access to resources. It offers various opportunities across various industries that can provide high investment returns.

With countries such as Mexico, Peru, Brazil, Colombia, Chile, and Argentina leading the way in regional investment destinations, Latin America is home to some of the best markets for investing.

These countries offer a variety of sectors and resources that lend themselves to investment opportunities.

Many Latin American countries are working hard to develop their economies through foreign direct investment (FDI), from oil and minerals to technology and infrastructure projects. This FDI provides investors with lucrative opportunities as companies look to capitalize on growing markets and numerous resources in the region.

The booming tech industry is also setting the tone for the growth in Latin American countries as startups and investors flock to the region to capitalize on its potential. This growing tech sector promises bright opportunities for investors looking to grow their portfolios with high-yield investments. With numerous markets across the continent, investing in Latin America is something for everyone.

Which Countries are Investing the Most in Latin

America

Latin America is a region of immense growth opportunities, which are being taken advantage of by many countries. The most active investors in the region include the United States, Canada, China, Japan, France, Germany, Switzerland, and South Korea.

These investors have been targeting Latin American markets since the 1980s and are key players in driving up foreign direct investment (FDI). These investments often focus on natural resources such as oil and minerals and infrastructure development projects.

How Much Is the U.S. Investing in Latin America

The United States is the largest foreign investor in Latin America, with $261.3 billion invested across the region. These investments focus on energy projects, infrastructure, financial services, and manufacturing.

In addition to this, U.S.-based investors also tend to focus their investments in the tech sector due to the region's potential for growth and its untapped resources, which can be leveraged efficiently by smaller businesses and startups.

Given that Latin American markets offer attractive opportunities for investors with a higher-than-average return rate compared to other global regions, it's no surprise that more and more U.S.-based companies are turning their attention south of the border and investing in businesses in the region.

How Much Is China Investing in Latin America

China has become one of the largest investors in Latin America over the past few decades. In 2019, Chinese investment in Latin American countries totaled an estimated $60 billion. This figure is expected to grow as China seeks opportunities to expand its global influence.

Some of the most popular investments from China are in energy, infrastructure, and technology-based projects. For example, Chinese companies have invested heavily in oil fields throughout Latin America, focusing on Venezuela and Brazil.

Additionally, China has committed funds to support several infrastructure-related initiatives, such as building ports and roads which help facilitate trade between these regions.

China's most recent type of investment is focused on technology-based startups and venture capital funds. This is an exciting opportunity for investors as it provides access to some of Latin America's most innovative and promising emerging technologies.

Top Places to Invest in Latin America

Chile

Chile is a top destination for investors looking to capitalize on Latin America's growth potential. With Decree-Law 600, non-resident investors can take advantage of regulations equal to those afforded local investors and benefit from the nation's relatively low corporate tax rate of 27%.

Not only that, but Chile has signed several trade agreements with countries worldwide since 2004, resulting in an increased import rate of 30% in its first year alone.

This progressive outlook towards foreign investment makes Chile attractive and one of Latin America's most actively pursued countries for international trade agreements. Investors would consider this South American nation well when planning their long-term portfolios.

Colombia

Colombia is a country full of investment potential. With the U.S. as its largest trading partner and nearly $30 billion in exports in 2021, it stands out among Latin American countries for its strong economy and diverse resources.

Within Colombia is an abundance of mineral fuels and oils that make up the majority of its exports. The country has taken steps to reduce corporate income taxes and incentivize foreign investment with tax breaks for investors who choose to do business there. This has made it an attractive option for expanding their portfolios into Latin America.

Along with a profitable market, Colombia also boasts numerous agricultural opportunities, offering investors even more chances to succeed within the region. Colombia is the ideal destination for anyone interested in investing in Latin America.

With a growing economy and plenty of resources to develop, it's no wonder why so many people are turning their attention to this thriving nation. Investing in Colombia could be the best move you make for your portfolio.

Peru

Peru is an attractive destination for investors due to its rapidly growing economy and abundant natural resources. In the past two decades, Peru has seen a significant transformation in GDP growth, poverty reduction, and loan financing from the World Bank.

Its major trading partner is China rather than the United States, which opens up further opportunities for investors looking to take advantage of the Chinese market. However, Peru's economy was hit hard by the coronavirus pandemic in 2020, resulting in reduced employment and a drop in GDP.

Despite this setback, Peru's economic recovery seems promising, with formal employment returning to pre-pandemic levels and investment projects increasing. With all this potential on offer, it's easy to see why investing in Peru is a sound investment decision.

Plus, with abundant natural resources and progressive government policies, Peru is an attractive investment destination in Latin America. Therefore, if you want to expand your portfolio to Latin America, Peru should be at the top.

Mexico

Mexico is an attractive investment destination due to its proximity to the U.S., its membership in NAFTA, and its accession to the USMCA. The country's economy has rebounded since the coronavirus pandemic hit in 2020, with exports reaching a record high.

Investors should look to Mexico's booming industries, such as manufacturing and energy, for potential investment opportunities. In addition, Mexico is home to some of the world's most desirable tourist destinations, like Cancun and Cabo San Lucas, which bring in billions of dollars each year from foreign visitors.

With its strong economic foundation and vibrant population, Mexico presents many lucrative investment possibilities for all kinds of investors.

In addition to traditional investments, Mexico is home to many innovative start-up companies looking for outside investors. From solar energy to blockchain, Mexico has proven to be an attractive location for tech companies and venture capitalists. With its economic stability and growing technology infrastructure, now is the perfect time to explore investing in Mexico's vibrant economy.

Investing in Mexico offers a variety of potential opportunities with a high return on investment. Investors can invest wisely in this rapidly developing market by leveraging the country's resources, vast population, and trade agreements with other nations.

FAQs

What country is investing heavily in Latin America?

China has invested heavily in oil fields throughout Latin America, focusing on Venezuela and Brazil.

What are the top places to invest in Latin America?

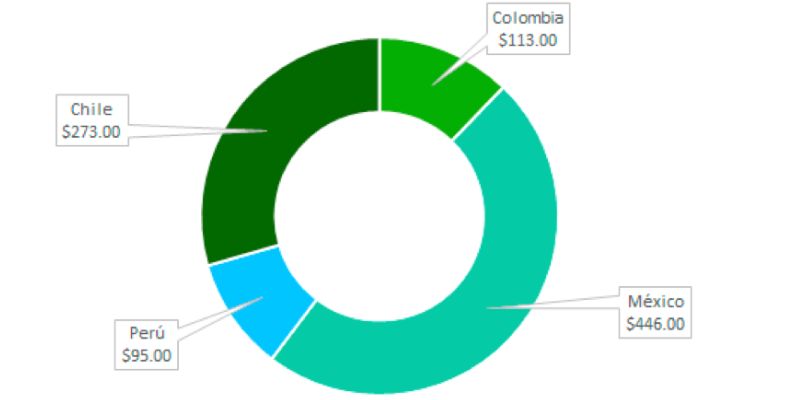

The top places to invest in Latin America include Chile, Colombia, Peru, and Mexico.

Why should I consider investing in Latin American countries?

Latin American countries offer vast potential for investment because of their booming tech hubs, resource-rich landscapes, and commitment to foreign investment. Investing in this region can provide a high return on investment with minimal risk when done correctly.

Conclusion

Despite all the economic turbulence Latin America has experienced over the last decade, it still stands as a vibrant and attractive investment opportunity. Investing in Latin America is now widely recognized to yield potential high returns – remember to research before venturing your hard-earned funds! Chile, Colombia, Peru, and Mexico show great promise for investors seeking to obtain profits with a lower-risk approach.